Accountable Plan For Home Office Deduction . beginning in tax year 2013 (returns filed in 2014), taxpayers may use a simplified option when figuring the deduction for business. the purpose of this publication is to provide information on figuring and claiming the deduction for business use of your home. You must complete an accountable plan. The third option, being reimbursed under an. the home office deduction allows qualified taxpayers to deduct certain home expenses when they file taxes.

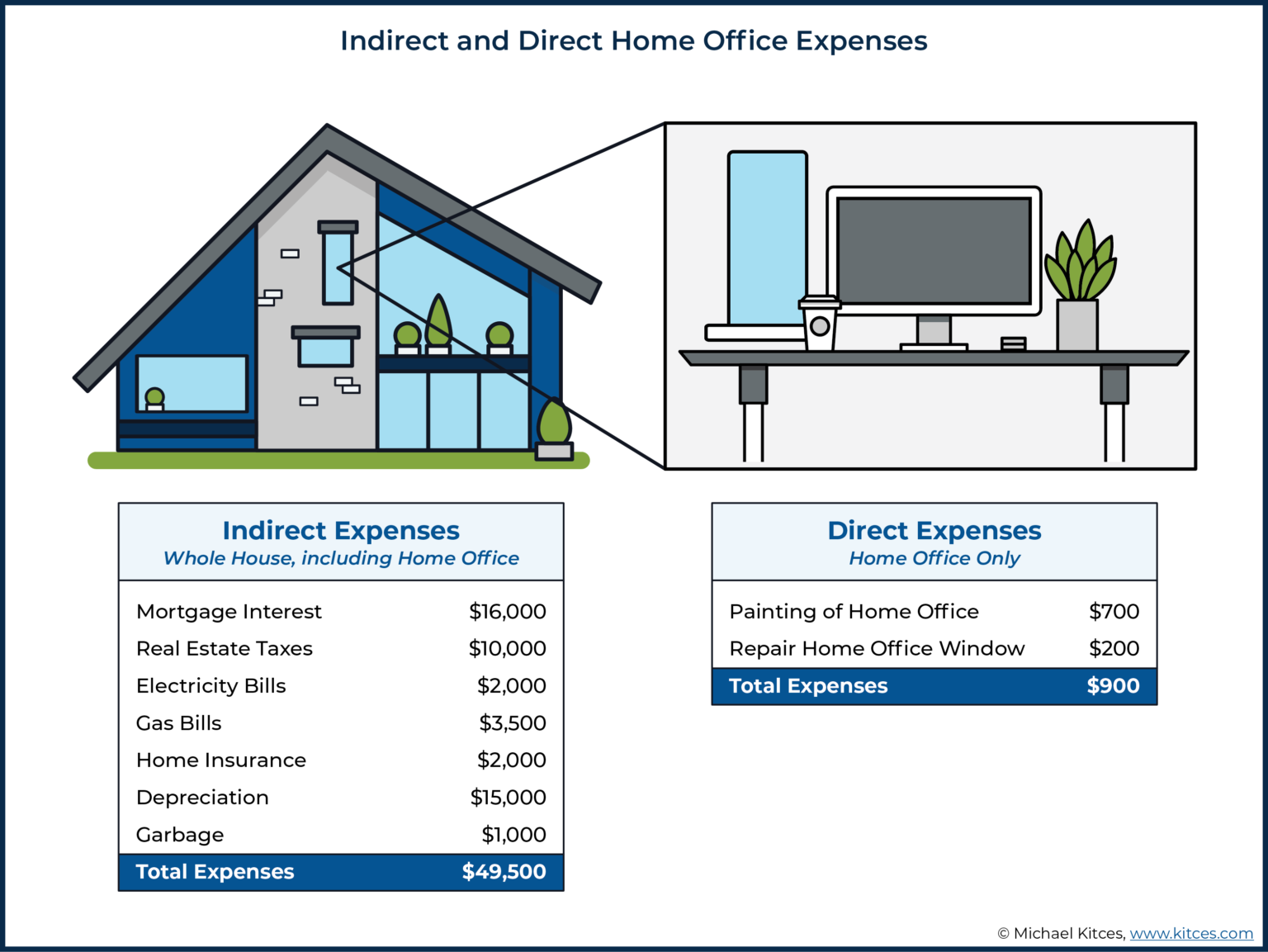

from www.kitces.com

You must complete an accountable plan. The third option, being reimbursed under an. the home office deduction allows qualified taxpayers to deduct certain home expenses when they file taxes. the purpose of this publication is to provide information on figuring and claiming the deduction for business use of your home. beginning in tax year 2013 (returns filed in 2014), taxpayers may use a simplified option when figuring the deduction for business.

Home Office Deduction Rules When Working From Home

Accountable Plan For Home Office Deduction beginning in tax year 2013 (returns filed in 2014), taxpayers may use a simplified option when figuring the deduction for business. beginning in tax year 2013 (returns filed in 2014), taxpayers may use a simplified option when figuring the deduction for business. the purpose of this publication is to provide information on figuring and claiming the deduction for business use of your home. The third option, being reimbursed under an. the home office deduction allows qualified taxpayers to deduct certain home expenses when they file taxes. You must complete an accountable plan.

From www.thebottomlinecpa.com

How to Determine Accountable Plan Reimbursements for Home Office The Bottom Line® CPA Accountable Plan For Home Office Deduction the home office deduction allows qualified taxpayers to deduct certain home expenses when they file taxes. beginning in tax year 2013 (returns filed in 2014), taxpayers may use a simplified option when figuring the deduction for business. You must complete an accountable plan. the purpose of this publication is to provide information on figuring and claiming the. Accountable Plan For Home Office Deduction.

From www.itilite.com

Complete Guide to Accountable Reimbursement Plan Accountable Plan For Home Office Deduction You must complete an accountable plan. beginning in tax year 2013 (returns filed in 2014), taxpayers may use a simplified option when figuring the deduction for business. the purpose of this publication is to provide information on figuring and claiming the deduction for business use of your home. the home office deduction allows qualified taxpayers to deduct. Accountable Plan For Home Office Deduction.

From exceldatapro.com

Home Office Deduction Definition, Eligibility & Limits ExcelDataPro Accountable Plan For Home Office Deduction The third option, being reimbursed under an. beginning in tax year 2013 (returns filed in 2014), taxpayers may use a simplified option when figuring the deduction for business. the purpose of this publication is to provide information on figuring and claiming the deduction for business use of your home. You must complete an accountable plan. the home. Accountable Plan For Home Office Deduction.

From templates.rjuuc.edu.np

Accountable Plan Template Excel Accountable Plan For Home Office Deduction You must complete an accountable plan. beginning in tax year 2013 (returns filed in 2014), taxpayers may use a simplified option when figuring the deduction for business. the purpose of this publication is to provide information on figuring and claiming the deduction for business use of your home. the home office deduction allows qualified taxpayers to deduct. Accountable Plan For Home Office Deduction.

From www.kitces.com

Home Office Deduction Rules When Working From Home Accountable Plan For Home Office Deduction The third option, being reimbursed under an. the home office deduction allows qualified taxpayers to deduct certain home expenses when they file taxes. beginning in tax year 2013 (returns filed in 2014), taxpayers may use a simplified option when figuring the deduction for business. the purpose of this publication is to provide information on figuring and claiming. Accountable Plan For Home Office Deduction.

From www.youtube.com

The Easiest S Corp Tax Strategy Home Office Deduction Accountable Plan YouTube Accountable Plan For Home Office Deduction beginning in tax year 2013 (returns filed in 2014), taxpayers may use a simplified option when figuring the deduction for business. the home office deduction allows qualified taxpayers to deduct certain home expenses when they file taxes. You must complete an accountable plan. The third option, being reimbursed under an. the purpose of this publication is to. Accountable Plan For Home Office Deduction.

From onlineaccounting.com

The Home Office Deduction, learn if you qualify 3 simple Accountable Plan For Home Office Deduction beginning in tax year 2013 (returns filed in 2014), taxpayers may use a simplified option when figuring the deduction for business. The third option, being reimbursed under an. the purpose of this publication is to provide information on figuring and claiming the deduction for business use of your home. the home office deduction allows qualified taxpayers to. Accountable Plan For Home Office Deduction.

From www.template.net

Accountable Plan Template [Free PDF] Accountable Plan For Home Office Deduction the home office deduction allows qualified taxpayers to deduct certain home expenses when they file taxes. The third option, being reimbursed under an. the purpose of this publication is to provide information on figuring and claiming the deduction for business use of your home. You must complete an accountable plan. beginning in tax year 2013 (returns filed. Accountable Plan For Home Office Deduction.

From edwardmgardnerpc.com

Using an IRS Accountable Plan to Maximize Deductions for Your Harris County Business Accountable Plan For Home Office Deduction The third option, being reimbursed under an. You must complete an accountable plan. the home office deduction allows qualified taxpayers to deduct certain home expenses when they file taxes. beginning in tax year 2013 (returns filed in 2014), taxpayers may use a simplified option when figuring the deduction for business. the purpose of this publication is to. Accountable Plan For Home Office Deduction.

From onlineaccounting.com

The Home Office Deduction, learn if you qualify 3 simple Accountable Plan For Home Office Deduction the home office deduction allows qualified taxpayers to deduct certain home expenses when they file taxes. You must complete an accountable plan. the purpose of this publication is to provide information on figuring and claiming the deduction for business use of your home. beginning in tax year 2013 (returns filed in 2014), taxpayers may use a simplified. Accountable Plan For Home Office Deduction.

From pescatorecooper.cpa

Home Office Deduction Pescatore Cooper, PLC Accountable Plan For Home Office Deduction the purpose of this publication is to provide information on figuring and claiming the deduction for business use of your home. the home office deduction allows qualified taxpayers to deduct certain home expenses when they file taxes. You must complete an accountable plan. beginning in tax year 2013 (returns filed in 2014), taxpayers may use a simplified. Accountable Plan For Home Office Deduction.

From www.pinterest.com

How S Corporation OwnerEmployees Can Adopt An Accountable Plan To Preserve The Home Office And Accountable Plan For Home Office Deduction The third option, being reimbursed under an. the home office deduction allows qualified taxpayers to deduct certain home expenses when they file taxes. beginning in tax year 2013 (returns filed in 2014), taxpayers may use a simplified option when figuring the deduction for business. the purpose of this publication is to provide information on figuring and claiming. Accountable Plan For Home Office Deduction.

From www.taxdefensenetwork.com

An Easy Guide to The Home Office Deduction Accountable Plan For Home Office Deduction The third option, being reimbursed under an. beginning in tax year 2013 (returns filed in 2014), taxpayers may use a simplified option when figuring the deduction for business. the purpose of this publication is to provide information on figuring and claiming the deduction for business use of your home. the home office deduction allows qualified taxpayers to. Accountable Plan For Home Office Deduction.

From www.investopedia.com

Accountable Plan Definition and Taxation on Reimbursements Accountable Plan For Home Office Deduction the home office deduction allows qualified taxpayers to deduct certain home expenses when they file taxes. The third option, being reimbursed under an. the purpose of this publication is to provide information on figuring and claiming the deduction for business use of your home. You must complete an accountable plan. beginning in tax year 2013 (returns filed. Accountable Plan For Home Office Deduction.

From epicofficefurniture.com.au

5 Home Office Deductions You Should Know About Epic Office Furniture Accountable Plan For Home Office Deduction The third option, being reimbursed under an. the purpose of this publication is to provide information on figuring and claiming the deduction for business use of your home. You must complete an accountable plan. the home office deduction allows qualified taxpayers to deduct certain home expenses when they file taxes. beginning in tax year 2013 (returns filed. Accountable Plan For Home Office Deduction.

From www.taxdefensenetwork.com

An Easy Guide to The Home Office Deduction Accountable Plan For Home Office Deduction The third option, being reimbursed under an. the home office deduction allows qualified taxpayers to deduct certain home expenses when they file taxes. You must complete an accountable plan. beginning in tax year 2013 (returns filed in 2014), taxpayers may use a simplified option when figuring the deduction for business. the purpose of this publication is to. Accountable Plan For Home Office Deduction.

From flyfin.tax

What's New For Home Office Tax Deduction in 2022? FlyFin A.I. Accountable Plan For Home Office Deduction You must complete an accountable plan. the home office deduction allows qualified taxpayers to deduct certain home expenses when they file taxes. beginning in tax year 2013 (returns filed in 2014), taxpayers may use a simplified option when figuring the deduction for business. The third option, being reimbursed under an. the purpose of this publication is to. Accountable Plan For Home Office Deduction.

From www.youtube.com

Reimburse your home office and mileage expenses with an accountable plan YouTube Accountable Plan For Home Office Deduction You must complete an accountable plan. the purpose of this publication is to provide information on figuring and claiming the deduction for business use of your home. beginning in tax year 2013 (returns filed in 2014), taxpayers may use a simplified option when figuring the deduction for business. the home office deduction allows qualified taxpayers to deduct. Accountable Plan For Home Office Deduction.